Candlestick charts: what are they?

Candlestick charts show the highest and lowest prices of a given asset over time. The lowest and highest opening and closing prices do not have wicks. The price for that period may be the highest when it is above the upper wick. Over the centuries, traders have used them to see where prices are headed. Rice traders in Japan are thought to be the originators of candlesticks. The trading platform has evolved significantly over the years and has become a key part of many traders’ tools. Due to its constant use and update over the years, this charting system is now one of the best available.

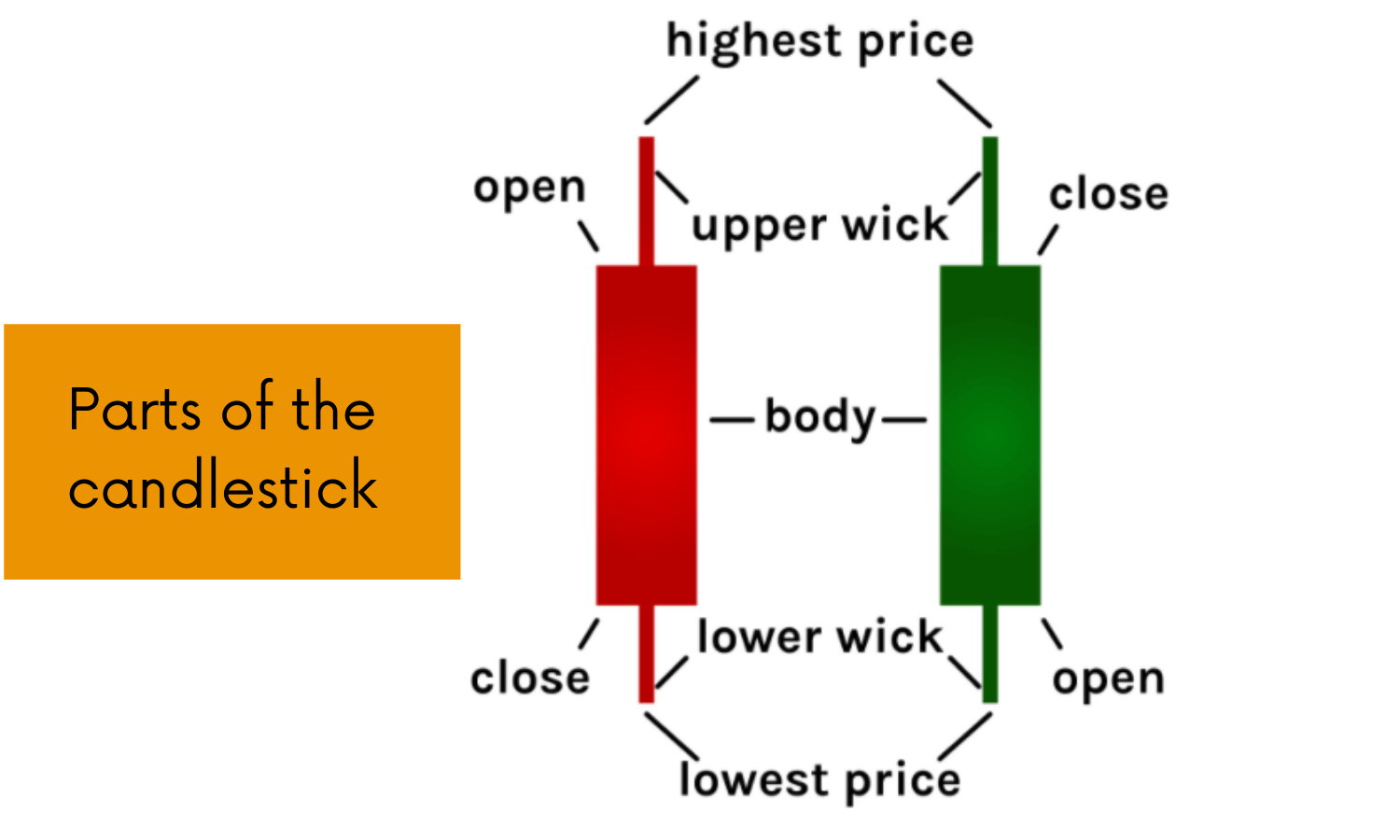

Here are the components of a candlestick:

A Red Candlestick

In the case of a red candle, the closing price was lower than the opening price. During the trading period, therefore, the asset’s price decreased. Think of the red candle above as an example of a one-minute candle. This implies a price has fallen below its opening price if that is the case.

A Green Candlestick

Generally, a green candle is an indication that the asset’s price increased and closed above its opening price.

Generally, Wicks shows the difference between the closing price, the opening price, as well as the highest and lowest price that was achieved during the specified period. Let us examine the green candle shown above. Upper wicks indicate that the price exceeded the closing price during the period. As the name implies, an upper wick is formed by dividing the highest achieved price by the closing price. A lower wick indicates the difference between the opening and the lowest price achieved during the same period.

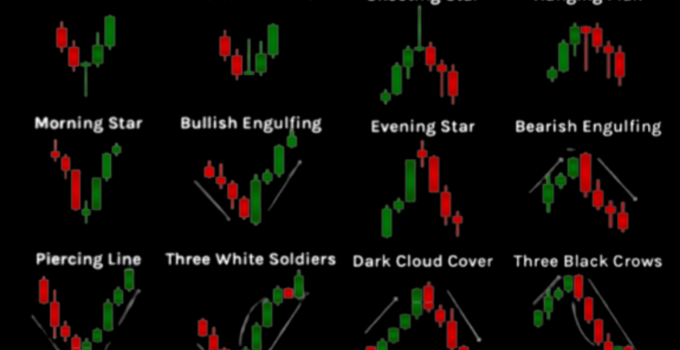

Candlestick patterns and their meaning:

A BULLISH PATTERN

Hammer

In candlesticks with an upper wick that is twice as long as the lower wick, the candlesticks usually show a downtrend. If rates are increasing, then either the market is improving or trending in the right direction.

Inverted hammer

Hammers have their long wicks below their bodies, not above them. The Inverted Hammer comes in two colors: green and red. Hammers indicate a possible uptrend start, but an inverted Hammer indicates the opposite.

Morning Star

A downtrend bottoms out with three candles. First, the wicks of the bear candles are long and the bodies are short, whereas in the second – called the star candle – the wicks are short and the bodies are long. During a star candle, the candle before it closes below it. Yet the third candle closes above the first candle’s midpoint, indicating a bullish shift.

Positive trends are gaining momentum in response to downward pressure patterns.

Bullish Engulfing

Traders are likely to have changed their sentiment based on this indicator.

Piercing Line

The candlesticks here start in bearish fashion, but there is a peak in buying pressure at the time of the second candle. Thus, it is highly likely that the Bulls will buy at current prices.

Three White Soldiers

This type of pattern indicates strong buyer pressure, which may lead to higher prices or may even indicate the beginning of a reversal. Bigger candles create more pressure.

A BEARISH PATTERN

Shooting Star

This pattern indicates a price decline after a dramatic rally. It is often considered a bearish reversal sign when the Shooting Star appears.

The Hanging Man

The appearance of such patterns indicates weakness in the trend and usually signals a sale.

Evening Star

Evening Star and Morning Star are opposed to one another. Traders may use it to sell positions if it indicates the current trend is losing strength. Third candles confirm the trend, starting a downward trend.

The Bearish Engulfing

As the candlesticks of a bearish engulfing oppose each other, it means that the trend is bearish. The first candle in the chart above is green (bullish) and the second candle is red (bearish). Bearish engulfing indicate the beginning of a downtrend and can be indicative of increased selling pressure.

Dark cloud cover

When coupled with high volume, the trend may indicate that momentum is shifting from upside to downside. Three red candles could confirm the pattern. There are three black crows within an uptrend that constitute the three

Black Crows pattern

Patterns like this indicate price drops are forthcoming and reversals of trend may be on the horizon.

Conclusion

Whether or not a trader uses a candlestick pattern directly in their trading strategy, candlestick patterns are essential to traders. The important thing to remember is, while they can be useful in analyzing markets, they are not backed by any scientific principles. Instead, they attempt to visualize the dynamics of purchases and sales in markets.